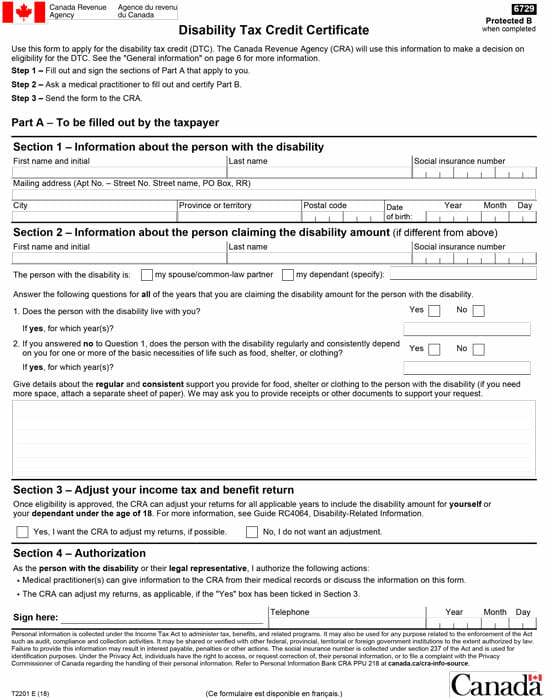

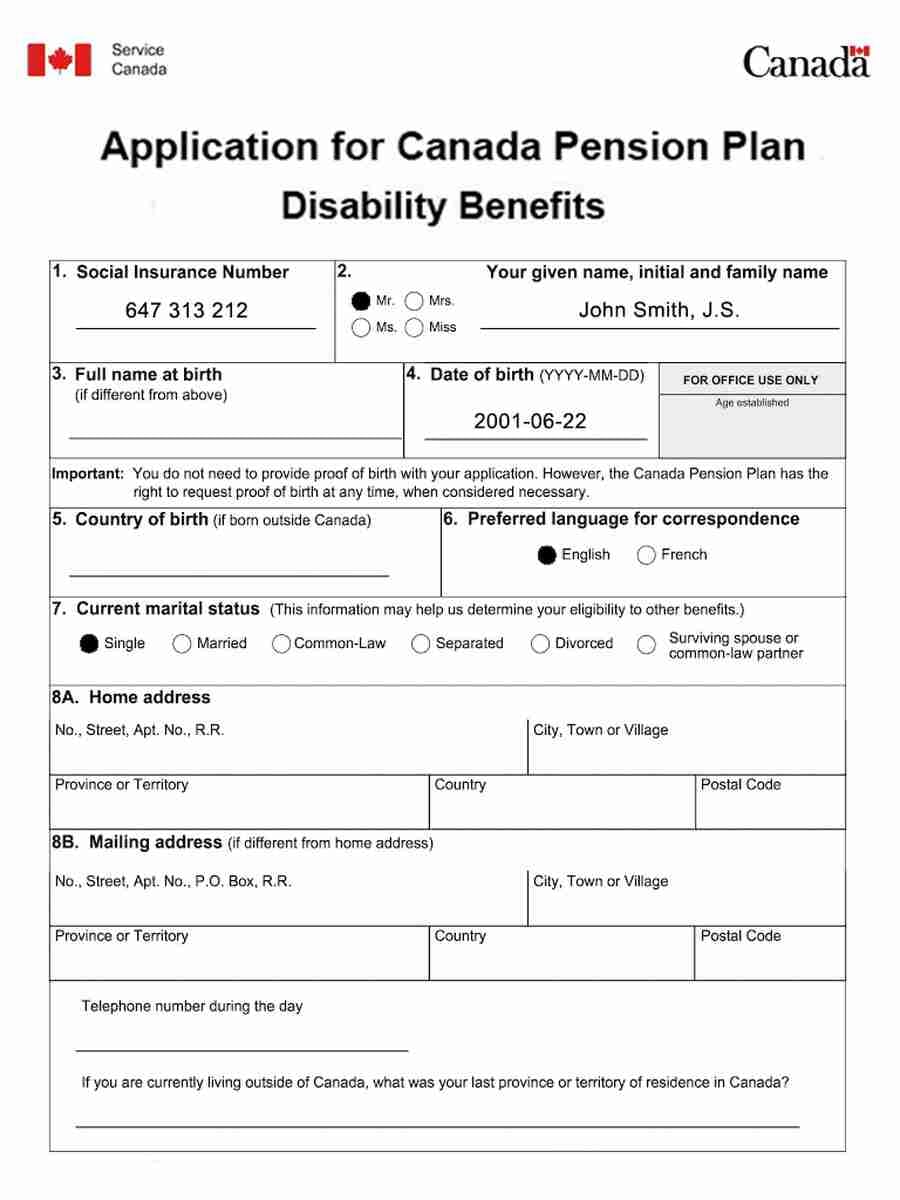

Fighting for Disabled Canadians Since 2014

We Have Over 90% Success with Disability Tax Credit & CPP Disability Applications! If We Can’t Help You, No One Can!

NO WIN – NO FEE!

Michelle. Child DTCReceived $10,754

Barbara. CPP-DReceived $19,845

Tony & Mari. DTCReceived $16,332