A Parents’ Guide To ADHD & The Disability Tax Credit

Do you have, or know someone who has, ADHD? Given its commonality, you very likely might. That’s why DCCI compiled resources from ADHD Experts across Canada in order to build out our new guide “A Parents’ Guide To ADD and The Disability Tax Credit”

Today, we’re going to talk about what ADHD is, and how it qualifies for Canadian Disability Tax Credits!

Content Table

- ADHD: An Overview

- Applying for the Disability Tax Credit with ADHD (For Children Vs. Adults)

- What Is ADHD?

- How Does ADHD Affect Executive Functioning?

- Is ADHD Considered A Disability In Canada?

- What Benefit Can You Claim for A Child With ADHD?

- What Are the Eligible Criteria For ADHD To Qualify For DTC?

- What Are the Disabling Effects of ADHD That Can Qualify For The Disability Tax Credit

- How To Apply For, And Qualify For The Child DTC

- Can an Adult with ADHD Qualify For The Disability Tax Credit?

- Are There Treatments for ADHD?

- Where Do I Send My DTC Application?

- Why Was My Application For DTC Denied And What Can I Do?

- Credit And Special Thanks

ADHD: An Overview

ADHD: Attention Deficit Hyperactivity Disorder.

It is the most underdiagnosed and misunderstood condition affecting Canadian children (and adults) today. In fact, 80% of school-age children diagnosed today will struggle with their symptoms into adolescence. At least 60% will maintain their symptoms into adulthood.

ADHD does not discriminate.

It can affect anyone from any background or any walk of life. What’s more, those with ADHD are at higher risk of suffering from unemployment, increased risk of poverty and mental illness, and are more likely to enter the workforce unskilled or semi-skilled.

As a misunderstood condition, those affected may be used to hearing that they fail to “apply themselves”- having their struggles attributed to a personal shortcoming. In reality, ADHD is not a personality trait. It is a real, scientifically-backed medical condition that has wide and varied effects on the brain.

Sounds sobering, doesn’t it? Don’t worry. We’ve got you.

Disability Credit Canada is a company that works with disabled Canadians across the country, advocating for them to get support through the Tax Credit system designed by the Federal Government. These tax credits exist to help those affected by conditions they cannot control.

Today, we are tackling ADHD.

Our company reached out across Canada to talk to leading industry experts, and those with lived experience with ADHD, to help inform and assist people looking to get support for their condition.

In this digital resource, we’re breaking down:

– What ADHD is and the ways it can affect the brain (Supported by experts!)

– What The Disability Tax Credit is, and how does it work

– How to apply for the Disability Tax Credit with ADHD as the condition

– Some current treatment options and resources for those affected by ADHD

Applying for the Disability Tax Credit with ADHD (For Children Vs. Adults)

Here’s the thing; ADHD does qualify for the Disability Tax Credit, but it is notably harder to qualify as an adult than as a child. In this digital guide, we’re going to focus mostly on minors affected with ADHD.

Now, if you are an adult with ADHD considering applying for the DTC, don’t worry. This resource will still provide you with all the information needed to build a strong application in your favor, and can be useful, regardless of age!

If you think it seems odd that a lifelong and chronic condition such as ADHD would have a higher DTC success rate for minors, you’ve got a point. There is a higher denial rate among adults. The reason for this is due to a general consensus that early detection and comprehensive treatment can mediate many of the effects of ADHD. In truth, with proper treatment, many sufferers can live happy, healthy, and productive lives.

So, by the time an individual is an adult, the hope is that the person has established strategies to assist them in coping with their condition. This is why qualifying with ADHD as an adult is very difficult, although not impossible.

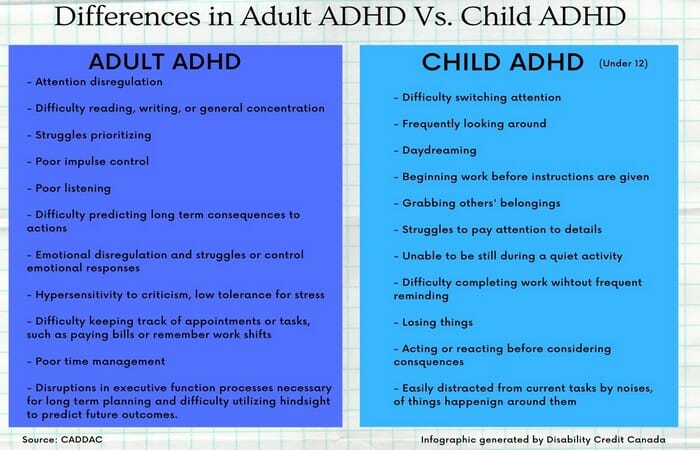

Adult ADHD tends to present differently in adults, than in children or adolescents. The below infographic helps explain the differences.

The idea that adults with ADHD have already developed strategies to cope with the condition makes sense. The irony behind this thinking though is that in order to learn those strategies and coping mechanisms, early support is key.

That’s where the DTC comes in.

What Is ADHD?

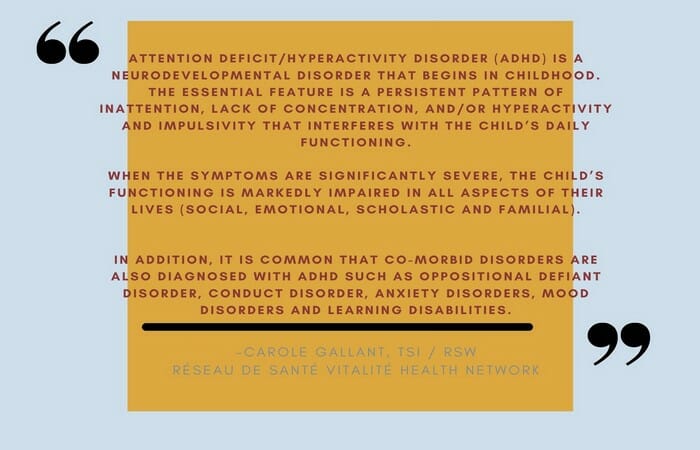

We’re glad you asked. To start, we will let contributor Carole Gallant of Vitalité Health describe this:

The term “ADHD” may conjure up images of “scatterbrained”, easily distracted, high-energy individuals, who frequently forget their keys and are constantly late to appointments. Their daily life may seem like the opening scene of a Comedy film, but in reality, the condition is far more nuanced than that.

ADHD, (“ADD” is becoming an outdated term) is a neurodevelopmental disorder. With overwhelming medical evidence in favor of ADHD as a real, medical condition deserving of recognition, there has been a push in recent years to more thoroughly understand the impairment. ADHD has a strong genetic component, and its’ inheritability leads to the likelihood of it running in families.

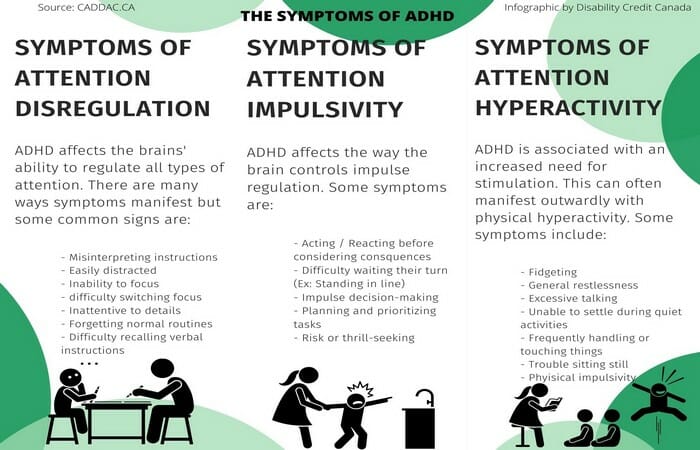

ADHD affects the brain’s ability to regulate all aspects of attention and focus. This means that every aspect of a person’s mental processes that involve their mental attention- from impulse control and emotional reactiveness to active listening to understanding the sequences of steps that lead to the desired outcome are all affected. The earlier ADHD is diagnosed – the better, for this purpose we created ADHD Test & Self-Assessment to help you check yourself independently before referring to the doctor.

Exhausting? You bet.

Now add onto that the common misconception that those with ADHD simply can’t “apply themselves” and a person with ADHD might be feeling pretty bad about themselves.

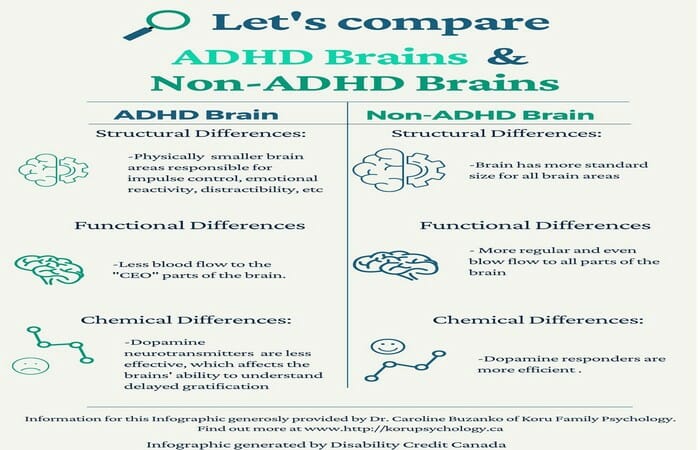

It’s important to know that those with ADHD have physically different brains than those without the condition. Their ability to regulate their attention against factors like sensory stimuli, exterior distractions, and even within the thoughts of their own mind, can be a constant struggle, regardless of the mental, the physical and emotional effort they use to “apply themselves”.

ADHD doesn’t stop at applying focus, but also regulating one’s ability to hyper-focus. Those with this condition can get so overwhelmingly absorbed in a task that it can create a “hyper-focusing” situation, where they are unable to “switch” their attention to another important task.

ADHD is understood currently to come in three categories, and this is one of the reasons the term “ADD” is becoming a retired term. ADHD is now classified into three subtypes:

– Mainly inattentive (ADHD-i)

– Mainly hyperactive (ADHD) *Rare*

– Combined symptoms of both (ADHD-c)

How Does ADHD Affect Executive Functioning?

You know ADHD regulates attention, distractibility, and focus, right? Is that all ADHD is?

Unfortunately, no.

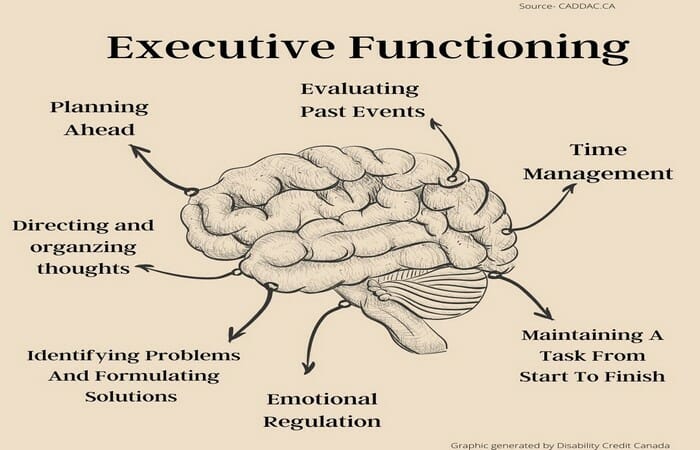

One of the most notoriously misunderstood traits associated with ADHD is its role on the Executive Functioning (EF) processes within the brain. As we will see, EF is massively important to our day-to-day lives. Challenges in EF processing can have drastic effects on a person’s world.

Okay, so what is Executive Functioning?

Executive Functioning (EF) is a critical mental skill set that enables individuals to think and plan ahead, start, organize and finish tasks, and prioritize the input from the world around them- including regulation of our emotional responses.

The processes of Executive Function are developed and reinforced as we age, and become a crucial part of our functioning as we enter adulthood.

Our brains are highly adaptable and with support and training, the EF processes of a person with ADHD can improve. Yet these factors can appear insurmountably difficult for school-age children.

Children must adapt to an educational environment where almost every moment is governed by a curriculum focused on tasks that require the use of their Executive Functioning skills.

For lack of a better metaphor, a minor with ADHD lacks the “processing power” to execute the thinking required to excel in a traditional academic setting.

The result is a minor who will struggle to cope with the demands of an academic environment due to a condition that makes focusing their attention more difficult. Add this situation to the list of emotional and social hurdles that accompany youth, and the stress becomes compounded. The combined pressures mounted onto a child that is naturally developing their EF processes more slowly than their peers, and suddenly it becomes clear why ADHD can have devastating effects on those who suffer from it.

Children with ADHD could be at social, emotional, and conceptual disadvantages from developing at a different pace than their peers. To quote Dr. Caroline Buzanko, of Koru Family Services:

Without support, treatment, compassion, and guidance, children with ADHD can struggle to adapt to the growing and multifaceted personal and academic responsibilities of adulthood. Even with support, the mental health of the individual can be affected, as we can see from this testimonial from a real ADHD sufferer.

Not sure if your child has ADHD?

Is ADHD Considered A Disability In Canada?

As we mentioned earlier- yes! ADHD does qualify as a disability, provided that the impairment is severe enough. Many cases of ADHD are mild or moderate in nature. With multi-modal treatment, the majority of those affected can live happy and fulfilling lives.

Yet, when we think about the impacts that ADHD can have on an individual’s life and the treatment required in managing the condition, it is fortunate that it qualifies for the Disability Tax Credit.

Now we must note that the diagnosis of ADHD is not the sole qualifier for The Disability Tax Credit. The severity of the condition and its effects on the daily life of the sufferer are the major deciding factors.

Whether or not your ADHD qualifies as disabling will depend on how it affects your life and the advice of medical professionals. A practicing medical professional will be required to fill out a section of the DTC application, providing detailed information about the way the individual’s life is severely affected.

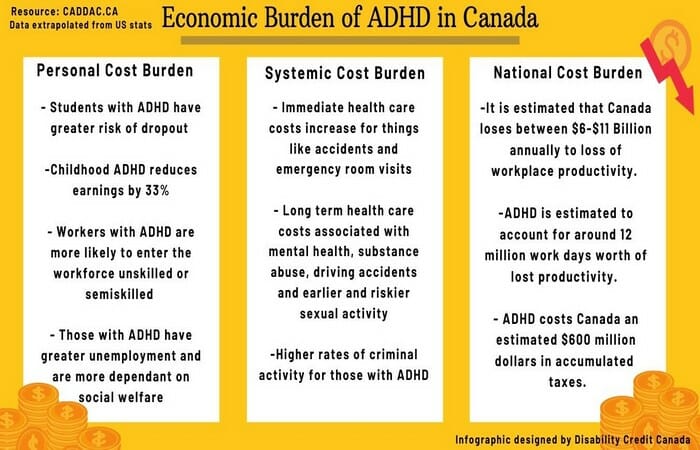

ADHD does not just cause stress to an individual and their family.

There is an economic cost shared systemically and socially when those with ADHD are not supplied with support. We broke those costs down with this handy graphic.

We can see that ADHD has an economic burden. One person without support for their condition has rippled effects on us all. This is one major reason why ADHD is considered a disability worthy of governmental assistance. ADHD remains one of the most easily treated conditions affecting Canadian children and with proper treatment, the effects of the condition can be managed.

But treatment for ADHD may come at an additional cost to those affected. That’s why it qualifies for Governmental Tax Credits.

ADHD is best managed with multi-modal treatment, meaning varied strategies that holistically approach the condition, tailored to the individual.

Treatments can include medication, tutors, special skills training, a healthy active lifestyle and additional therapies. All of these can greatly improve the management of ADHD symptoms and support a healthy and productive life for those affected.

John Stevenson, a diagnosed ADHD-er, sports psychology expert, and ADHD specialist explains some of the alternative and co-management treatments that can assist a person with the condition.

Unfortunately, many of these resources come at an additional cost. Waitlists for free services can be very long. Qualifying for the DTC can offset these expenses.

What Benefit Can You Claim for A Child With ADHD?

If you or someone you love has ADHD, you may be feeling a little discouraged right now.

Don’t be.

As we mentioned earlier, ADHD is highly treatable. There are a number of resources available to children with ADHD and their families. We’ve listed several at the bottom of our article.

The Government of Canada also has a reference page available online to determine what further tax credits and deductions a person with a disability may be eligible to receive.

The government also provides additional resources for those with ADHD, which we are talking about in more detail later in this resource. These include the Disability Tax Credit and the Child Disability Tax Credit.

The general goal of the government’s Disability Tax Credit is to assist Canadians and their families/supporters dealing with disabilities.

Okay, So What IS The Disability Tax Credit?

The DTC acts as a non-refundable tax credit used to reduce the amount of income taxes the family/individual needs to pay annually. When you claim the Disability Tax Credit for yourself or an adult you care for, you receive a base amount.

The Child Disability Tax Credit is a credit based on the taxes you pay (or intend to pay) every year. You cannot claim the Child Disability Tax Credit if you have not filed taxes for that year, or do not have taxable income for that year.

When you claim the Child Disability Tax Credit, you will receive the base amount from the Disability Tax Credit and a supplemental amount in addition to the base amount.

Great! So now we know what the credits are.

Let’s find out how to apply for them with ADHD as the condition.

What Are the Eligible Criteria For ADHD To Qualify For DTC?

The Government of Canada explains the eligibility for the DTC on its website. But let’s break it down for you here:

To be considered eligible for the DTC a person must meet one of the following criteria:

– Be blind

– Be markedly restricted in at least one of the basic activities of daily living

– Be significantly restricted in two or more of the basic activities of daily living (including vision problems)

– Need life-sustaining therapy (such as dialysis or insulin)

The qualifying individual must also meet all of the following criteria:

– Their condition must be deemed prolonged, meaning it must have lasted or be expected to last at least 12 months

– Be present at all times, or the majority of the time (90%)

At first glance, this might not seem relevant to ADHD, yet ADHD qualifies under “ the basic activities of daily living ”.

The challenge for the DTC application is that the applicant must prove that the claimant is “markedly restricted” by their ADHD in areas of their daily living.

To be considered “markedly restricted” the individual must be unable to, or just take an “inordinate amount” of time to, accomplish one or more of the tasks of daily life, even once factoring in assistance. An “inordinate amount of time” is generally considered about three times the length of the average expected time.

The “Basic Activities of Daily Living” include:

– Speaking

– Hearing

– Walking

– Eliminating (bowel or bladder problems)

– Feeding

– Dressing

– Mental functions needed for daily life, such as:

– Adaptive functioning (caring for ones’ self, ability to initiate and respond to social interactions and common, simple transactions)

– Memory (such as remembering simple instructions, basic personal information or important details necessary for daily functioning)

– Problem-solving, goal setting, and judgment, taken together (such as setting the desired outcome on an achievable goal, and then planning and executing the steps to achieve that goal)

You might think that the above list wouldn’t qualify for someone with ADHD. After all, a person with ADHD may be completely capable of walking, dressing, hearing, feeding themselves, etc. The activity to pay attention to is the “Mental Functions” required for daily life.

A person with ADHD has:

– A life long, chronic condition, which is present at all times, qualifying them as a “prolonged”

– Depending on the severity, their life can be affected by the condition on a daily basis which can be deemed “severe”.

The most important factor in your application is to describe how the claimant’s mental functioning is reduced, and accommodations for this reduction take on average 3x times as long as normal.

We know that ADHD affects memory, leading to difficulties with information recall, simple transactions and remembering instructions. We know that ADHD affects attention, including emotional regulation, which can affect social interactions and responses. Finally, we know that ADHD affects the Executive Functioning processes in the brain responsible for judgment, planning, and goal setting.

Therefore; a child with ADHD qualifies for the Disability Tax Credit, as being “markedly restricted” in at least one of the areas of Basic Activities of Daily Life; mental functions.

What Are the Disabling Effects of ADHD That Can Qualify For The Disability Tax Credit?

Okay, so you know what the Disability and Child Disability Tax Credit are.

You know that ADHD qualifies for the Tax Credit.

How exactly do you write an application for the DTC that showcases the condition in a way that gets it approved?

That’s our next stop.

Since children with ADHD may develop their Executive Functioning processes at a slower rate than their peers, describing the ways their lives are negatively affected by their ADHD is crucial to a successful application.

And, Executive Functioning is not the only thing affected in the mental processes of a person with ADHD. To quote Dr. Natasha Sharma, Co-founder of The 8-Hour Therapist:

It is true that small lapses in memory or judgment may happen to everyone at some point, but a person with ADHD deals with these lapses to a life-altering degree. Conventional tools that help others (appointment reminders, phone alerts, etc) may not be sufficient to assist them. It is important to make this a clear distinction in your application.

Here are some examples of (fictionalized) situations where an individual’s ADHD is actively negatively affecting their lives:

Example #1

Morgan is a ten-year-old with ADHD. They have a homework assignment that should take about 45 minutes. In order for Morgan to complete thetask, their parents must remind them the moment they get home to take out their homework. Their parents must then monitor them while they do the assignment, reminding them to stay on task, as they get distracted. Then their parents must review the assignment to ensure it is fully complete and assist them if it is not. After completion, the parent must help Morgan remember to pack the completed assignment in their backpack and remind them multiple times to ensure they turn it in the next day. The total time from start to finish on this task is almost 2.5 hours- more than triple the time for an “average” student. This classifies as markedly restricted.

Example #2

Taylor is a 7 year old with ADHD at a neighborhood birthday party. Even though their parents remind them to slow down and stay patient and calm at the party, Taylor gets very excited by the event. Taylor talks loudly and excessively, even over the child who is celebrating their birthday. Taylor struggles to wait their turn in line for party games, which causes a scene because it upsets the other guests and delays the games. Taylor is asked to leave the party early, and throws a tantrum that they struggle to calm down from. Taylor is not invited back to any parties in the future. At school, they are isolated by their peers who attended the party and remember Taylors’ lack of social control.

Example #3

Alex is a 16 year old with ADHD and a part time job. To help remember their shift time, they call the company twice to confirm it, and focus intently on putting the shift time down in four different places: Their agenda, their families’ calendar, their phone, and on the back of their hand. Unfortunately, they failed to anticipate the time it takes to travel to their job, and still end up arriving late. The added stress, and sense of failure, means they perform poorly in the role, and consequently get fewer shifts. The amount of time they spent planning in order to remember their shift time remains roughly triple that of an “average” person, who could remember their shift time after one reminder, and can anticipate travel time.

Each of these examples shows how, even with the very best efforts, a minor with ADHD faces markedly restricted challenges in the daily activities of their life, creating social and practical problems. For each of these scenarios, the impaired person is not exhibiting a lack of care, but struggling to regulate their attention in a way that makes their desired goals attainable.

Robin Storfer of Take Flight Coaching, explains that it is not always a lack of attention or care, but a lack of ability to regulate that attention, that leads to struggles.

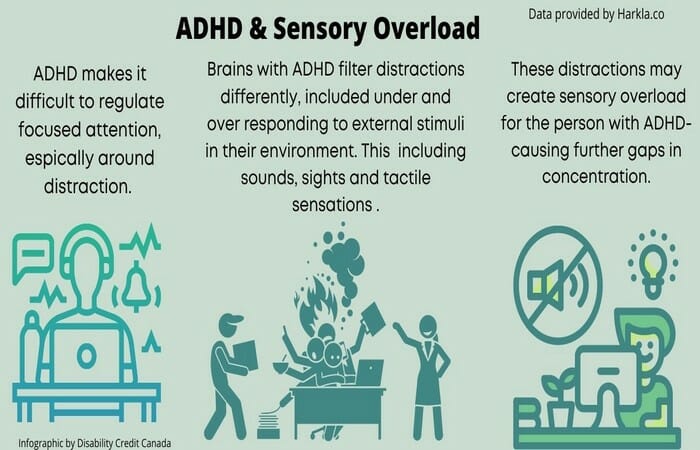

It is not solely attention regulation that creates struggles for ADHD individuals. It is also how that attention is managed and filtered out through the distractions of the world around them. You can see this in example #2 with 7 year old Taylor, who becomes so over-stimulated by birthday party activities that they fail to both regulate their emotions and properly respond to social cues.

You can see a clearer example of what that can look like through the infographic below, which pulls data from Harkla.co:

When applying for the DTC, it is important to include robust information from an authoritative source (likely a registered medical professional) that can vouch for the difficulties the individual with the condition suffers because of their impairment.

Now that we understand HOW to explain the difficulties of ADHD in relation to the DTC application and guidelines, let’s take a look at what the application process looks like.

How To Apply For, And Qualify For The Child DTC

When you apply for the Child Disability Tax Credit, the parent applying on behalf of the child must meet all of the following criteria:

– Must live with the child, and the child must be a minor under 18 years of age

– Must be the primary care-giver and be actively bringing up the child

– Must be a resident of Canada (for tax purposes)

Applying for the Child Disability Tax Credit is fairly straightforward, although quite detailed.

The application is presented in two parts; Part A and Part B.

PART A

Part A breaks down four general sets of information for the application:

1) Basic Information

The first part of this application contains the information of the Child seeking the benefits, and the information of the claimant (parent, guardian or caretaker). This information includes names, addresses, birthdays and Social Insurance Numbers.

2) Details About The Claimant

The second section of Part A requires more detail about the claimant, such as what the claimant does that supports the individual with the disability.

3) Consent For CRA’s Review

In the third section of Part A, you are giving consent to the CRA to review and adjust your income tax credit from the previous years, in order to access the amount eligible for the years you are applying for.

4) Signature

Finally, in part four, you will be required to sign the form itself. Signing this part of the form allows your registered medical provider to give your information to the CRA, in order for the CRA to review the required details to adjust your tax return.

PART B

Part B of the application process is a T2201 Form, which is filled out by a medical practitioner.

This part of the application must thoroughly describe the disability and how its effects are severe enough to hinder the individual. (See Examples from Previous sections)

For someone with ADHD, focusing on mental functions may be the most effective way to describe the challenges for the child’s condition.

These medical notes can be filled out by a doctor, nurse or any recognized medical professional.

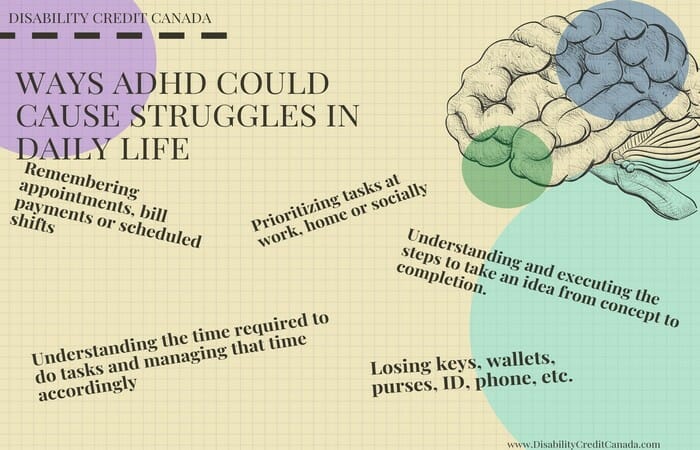

For example, individuals with ADHD may have difficulty with their ability to create realistically attainable goals and execute plans in order to reach those goals. It could affect their ability to prioritize their tasks, make and keep plans, or follow through on tasks that will positively impact their lives. Some examples of these struggles can be seen below:

ADHD exists on a spectrum, and the condition affects people in different ways and can present differently in everyone. Yet the conditions’ sweeping effects can still make an individual struggle in a variety of ways throughout their daily life. As Dr. Nastasha Sharma explains:

If you are describing the limitations of the individual, it will be crucial to provide examples of how ADHD has hindered their mental functions in profound and constant ways.

Can an Adult with ADHD Qualify For The Disability Tax Credit?

As we’ve mentioned in previous sections, applying for the Disability Tax Credit with ADHD as an adult can be very difficult- but not impossible.

We’ve already established that ADHD is a chronic, life-long condition. The challenge of applying as an adult is proving the severity of the condition and the ways the individual’s mental functioning is affected to a disabling degree.

To quote Wayne O-Brien, a professional with Seeds Of Hope and an Adult diagnosed with ADHD:

If you or someone you love is applying for the Disability Tax Credit as an adult with ADHD, be prepared to explain the severity of the impairment and how it affects the individual’s daily life, in spite of the accommodations that may be being used to provide assistance. It is also important to have the medical practitioner assist in filling out the form to detail the severity of the condition and its impact on the affected individual’s life.

As an example, if an affected adult struggles to remember bill payments, even after setting up reminders, or fails to keep vital appointments such as jobs shifts, or takes an inordinate amount of time to complete a necessary task, like balancing a cheque book, their ADHD symptoms may make them “markedly restricted” in the “mental functions necessary for everyday life” in the areas of adaptive functioning (mental transactions), memory, and goal-setting/problem solving/judgment.

Are There Treatments for ADHD?

Okay- so you know what ADHD is, and how it can affect the sufferer.

You know what the DTC is and how it works.

You know how to fill out your application.

Now what?

The Disability Tax Credit can take time to process, but your loved one with ADHD is actively in need of support. What resources are available to them?

While there is no “one-size-fits-all” approach to treatment when dealing with ADHD. Research shows the best approaches are multi-modal and tackle multiple facets of the individuals’ life. This might include a combination of treatments such as regular exercise, medication, specialized therapy to help work through social and behavioral impulses, and training for parents or caregivers to help reinforce the development of executive function through the routine of homelife. Learning Strategies proposed by Dr. Julia Ryan have been included below.

There are multiple types of support people with ADHD and their families can access. We’ve linked several from our resource contributors at the end of our guide.

Not sure if your child has ADHD?

Where Do I Send My DTC Application?

Once you and your registered medical practitioner have completed the application for The Child Disability Tax Credit / The Disability Tax Credit Certificate Form T2201, you will be able to send in the application in two different ways.

1) Submitting electronically through CRA My Account

Submitting electronically has many benefits, including being able to check the status of your application. However, it also requires access to a computer and an internet connection.

2) Submitting a physical copy by mailing it to one of the Tax Locations.

Submitting a physical copy means you are able to simply put your application in the mail. However, this method may make it more difficult to track the status of your claim.

It takes, on average, between three to six months to receive a response from the CRA regarding the status of a claim, including if your case has been deemed eligible for benefits, and the reassessment of your previous years’ taxes if the claim qualifies. This is an estimated number and it can sometimes take longer. In some cases, it can take over a year.

Why Was My Application For DTC Denied And What Can I Do?

Unfortunately, having a claim denied is not uncommon, but there are options available for you. In fact, a person who has been denied their Disability Tax Credit claim can re-apply as many times as they like because there is no limit to the number of attempts an individual can make.

If your claim was previously denied, you may want to consider re-evaluating the information provided in the form.

In many cases, the CRA will describe the reason you were denied. It is possible that the CRA did not feel they had enough viable information to deem the case eligible. This does not mean that you do not qualify. It simply means that when you re-apply you will need to provide more detailed information about the severity of the condition. You may also need to ensure that the severity of the condition is clearly described by the medical practitioner.

In the event that you are denied, you can also appeal the CRA’s decision. To appeal, you must contact the CRA in writing, and they will assign you an appeal officer. This process can take up to nine months. The officer will review your case and review your claim to make a decision. In cases such as these, there may be new paperwork and follow-up correspondence required. Some people choose to consult a specialized Disability Tax Credit Firm for assistance with the appeal process.

Disability Credit Canada is one such firm, with experience helping thousands of Canadians and their families navigate the process of application through to qualifying, including appealing when necessary. With years of combined experience, our company has a 95% approval rate for the cases we work with. We are not paid for our services unless the case wins.

We produce guides to walk individuals interested in applying through the application process free of charge. If you are looking for more resources, please check out our free guides below.

Disability Tax Credit Calculator

The Definitive Guide To The Child Disability Tax Credit

The Ultimate Disability Tax Credit Guide

CREDITS AND SPECIAL THANKS

Our mission is to help disabled Canadians qualify for Disability Tax Credit, CPP Disability Benefits, and Long term Disability benefits In this endeavor, we have worked with thousands of Disabled Canadians and we recognize the difficulties they face in their everyday life. Disability Credit Canada curated this guide with the generous support of several contributing individuals, entities and organizations who specialize in or have lived experience with ADHD. They have donated their time and energy to supply us with research, statistics, and testimonials on their work. We have credited and linked these groups below as well as their resources.

For further information on ADHD, and to be in touch with the advocacy groups we consulted for our article, please see the list below.

CONTRIBUTING ENTITIES, RESOURCES AND LINKS

1) Christina Crowe, H.BSc. MACP, RP, (Cert), OAMHP, Registered Psychotherapist & Clinical Supervisor Certified Clinical Trauma Professional (CCTP) ADHD Coach Owner & Clinic Director, Dig A Little Deeper

2) Caroline Buzanko, Registered Psychologist, Koru Family Psychology

3) Wayne O’Brien, BBA, TESL, CTM, ALWF, Seeds Of Hope

4) Dr. Julia Ryan, Ph.D., C. Psych (Supervised PRactice)

5) Brad Davey, Executive Director Connex Ontario Health Services Information

6) Kirc Cobb, Data, Product and Project Management- Senior Business Technical

7) Support Specialist, ConnexOntario

8) What is sensory overload, and how does it relate to ADHD?, Lead Happiness Ninja, Harkla Happiness,

9) Leigh Vanderloo, PhD. Knowledge Translation Manager, ParticipACTION

10) Despina Debbie Papadakis, RP CHt (Registered Psychotherapist, Clinical Hypnotherapist)

11) Vitalité Health Network (courtesy of Carole Gallant)

12) John Steveson, Zone Psychology Inc.

13) Dr. Natasha Sharma, Founder NKS Therapy, Creator of The Kindness Journal, Co-Founder of The 8-Hour Therapist

14) Christine Knox, MSW, RSW, Registered Social Worker, Toronto Nuerofeedback and Psychotherapy Centre .

15) Robin Storfer, MSW, ACPC, PCC, Take Flight Coaching

16) Rebecca Steinhubl, You Are Collective

17) Dusty Chipura, Vancouver ADHD Coaching

18) Josh Harney, OCT, MT, Director of Education, Trails Youth Initiatives